Working with Multiple Contracts

In the previous chapter, we focused on rules describing the behavior of a single contract. In practice, most protocols consist of multiple interacting contracts. In this chapter, we discuss techniques for verifying protocols involving multiple contracts.

We begin by walking through a running example protocol and explaining the Prover’s default behavior when it encounters calls from one contract to another. We then show how to handle a protocol consisting of multiple contracts whose implementation is known. After that, we discuss dispatcher summaries, an important technique for handling contracts whose implementation is not known at verification time. Finally, we give a concrete and reusable setup for a very common case: a contract that can work with many different ERC20 implementations.

The entire running example for this chapter can be found here.

Example protocol

To demonstrate these concepts, we work with a simplified liquidity pool contract called

Pool.

The full specification is in

certora/specs/Full.spec (although this chapter only discusses the

integrityOfDeposit and flashLoanIncreasesBalance properties) and the

final run conf is in runFullPool.conf.

The liquidity pool allows users to deposit and withdraw a single fixed type of

ERC20 token (the asset). The liquidity pool itself is an ERC20 token and

balance in the liquidity pool token denotes the shares in the pool.

We’ll reserve the words amount and assets to denote balance in the asset.

So, in return for depositing assets the user receives shares in the pool.

Withdrawing decreases the user’s shares and increases the user’ assets.

Here is the interface for the pool, followed by the Pool’s code.

pragma solidity >=0.8.0;

import "./IERC20.sol";

interface IPool is IERC20 {

// Deposit amount of underlying token returning the amount of shares minted to msg.sender

function deposit(uint256 amount) external payable returns(uint256);

// Withdraw shares and returns the anount of underlying token transfered to msg.sender

function withdraw(uint256 shares) external returns (uint256);

// Flashlaon an amount of underlying token and calls reciverAddress

function flashLoan(address receiverAddress, uint256 amount) external ;

}

Pool.sol

import {IFlashLoanReceiver} from './IFlashLoanReceiver.sol';

import {ERC20} from './ERC20.sol';

import {IERC20} from './IERC20.sol';

pragma solidity >=0.8.0;

contract Pool is ERC20 {

uint256 private constant _NOT_ENTERED = 1;

uint256 private constant _ENTERED = 2;

uint256 private _status;

modifier nonReentrant() {

// On the first call to nonReentrant, _notEntered will be true

require(_status != _ENTERED, "ReentrancyGuard: reentrant call");

// Any calls to nonReentrant after this point will fail

_status = _ENTERED;

_;

// By storing the original value once again, a refund is triggered (see

// https://eips.ethereum.org/EIPS/eip-2200)

_status = _NOT_ENTERED;

}

IERC20 public asset;

uint256 private constant feePrecision = 10000;

//feeRate is up to 1%, so less than 100 as it is divided by feePrecision

uint256 public feeRate;

uint256 public depositedAmount = 0;

function sharesToAmount(uint256 shares) public view virtual returns (uint256) {

return shares * depositedAmount / totalSupply();

}

function amountToShares(uint256 amount) public view virtual returns (uint256) {

return amount * totalSupply() / depositedAmount;

}

function deposit(uint256 amount) public nonReentrant() returns(uint256 shares) {

if (totalSupply()==0 || depositedAmount == 0){

shares = amount;

}

else{

shares = amountToShares(amount);

require (shares != 0);

}

asset.transferFrom(msg.sender,address(this),amount);

depositedAmount = depositedAmount + amount;

_mint(msg.sender,shares);

}

function withdraw(uint256 shares) public nonReentrant() returns (uint256 amountOut) {

uint256 poolBalance = asset.balanceOf(address(this));

require (poolBalance != 0);

amountOut = sharesToAmount(shares);

require (amountOut != 0);

_burn(msg.sender,shares);

asset.transferFrom(address(this),msg.sender,amountOut);

depositedAmount = depositedAmount - amountOut;

}

function flashLoan(address receiverAddress, uint256 amount) nonReentrant() public {

uint256 totalPremium = calcPremium(amount);

require (totalPremium != 0);

uint256 amountPlusPremium = amount + totalPremium;

asset.transferFrom(address(this),msg.sender,amount);

depositedAmount = depositedAmount - amount;

require(IFlashLoanReceiver(receiverAddress).executeOperation(amount,totalPremium,msg.sender),'P_INVALID_FLASH_LOAN_EXECUTOR_RETURN');

asset.transferFrom(msg.sender,address(this),amountPlusPremium);

depositedAmount = depositedAmount + amountPlusPremium;

}

function calcPremium(uint256 amount) public view returns (uint256){

return ((amount*feeRate)/feePrecision);

}

function assetBalance() public view returns (uint256) {

return asset.balanceOf(address(this));

}

}

For demonstration purposes, we have also added function assetBalance, which

returns the pool’s balance of the underlying asset (we’ll see

later that this is not necessary):

function assetBalance() public view returns (uint256) {

return asset.balanceOf(address(this));

}

Users can also take out flash loans - loans that must be repaid within the same

transaction. To do so, the user calls flashLoan, passing in a

FlashLoanReceiver contract and the desired number of tokens. The flashLoan

method transfers the tokens to the receiver, calls the executeOperation

method on the receiver, and finally transfers the tokens (plus a fee) from the

receiver back to the pool:

function flashLoan(address receiverAddress, uint256 amount) nonReentrant() public {

uint256 totalPremium = calcPremium(amount);

require (totalPremium != 0);

uint256 amountPlusPremium = amount + totalPremium;

asset.transferFrom(address(this),msg.sender,amount);

depositedAmount = depositedAmount - amount;

require(IFlashLoanReceiver(receiverAddress).executeOperation(amount,totalPremium,msg.sender),'P_INVALID_FLASH_LOAN_EXECUTOR_RETURN');

asset.transferFrom(msg.sender,address(this),amountPlusPremium);

depositedAmount = depositedAmount + amountPlusPremium;

}

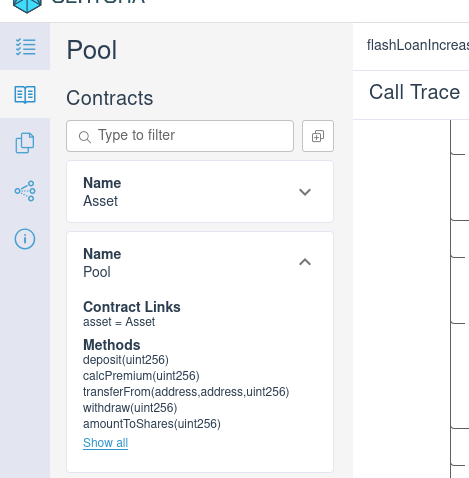

Our goal is to prove properties about the Pool contract, but we will need to

interact with the entire combined protocol consisting of the Pool contract,

the Asset contract, and the FlashLoanReceiver contracts. We will begin by

explaining the default behavior of the Prover when making external calls to

unknown contracts. We will then show how to link the specific Asset contract

implementation to the Pool contract. Finally, we will show some techniques

for reasoning about the open-ended set of possible FlashLoanReceiver

implementations.

Handling unresolved method calls

To start, let’s write a basic property of the pool and run the Prover on the

Pool contract to see how it handles calls to unknown code.

Here is a simple property:

/// `deposit` must increase the pool's underlying asset balance

rule integrityOfDeposit {

mathint balance_before = assetBalance();

env e; uint256 amount;

require e.msg.sender != currentContract;

deposit(e, amount);

mathint balance_after = assetBalance();

assert balance_after == balance_before + amount,

"deposit must increase the underlying balance of the pool";

}

This rule makes a call to Pool.deposit(...), which in turn makes a call to

asset.transferFrom(...); to understand the behavior of deposit the Prover

must also reason about the Asset contract. If we verify the rule without

giving the Prover access to the Asset code, the call to transferFrom(...)

will be unresolved.

By default, the Prover will handle calls to unresolved functions by assuming

they can do almost anything — we say that the Prover “havocs”

some part of the state. The part of the state that is havoced depends on the

type of call: calls to view functions are allowed to return any value but can

not affect storage (a NONDET summary), while calls to non-view functions are

allowed to change the storage of all contracts in the system besides the

calling contract[1] (a HAVOC_ECF summary). See

AUTO summaries in the reference manual for complete details.

We can see this behavior by verifying the integrityOfDeposit rule against the

Pool contract without giving the Prover access to the Asset contract.

The JustPool.conf config file does

just that, run it using:

$ certoraRun JustPool.conf

In this case, the integrityOfDeposit rule fails. To understand why, we can

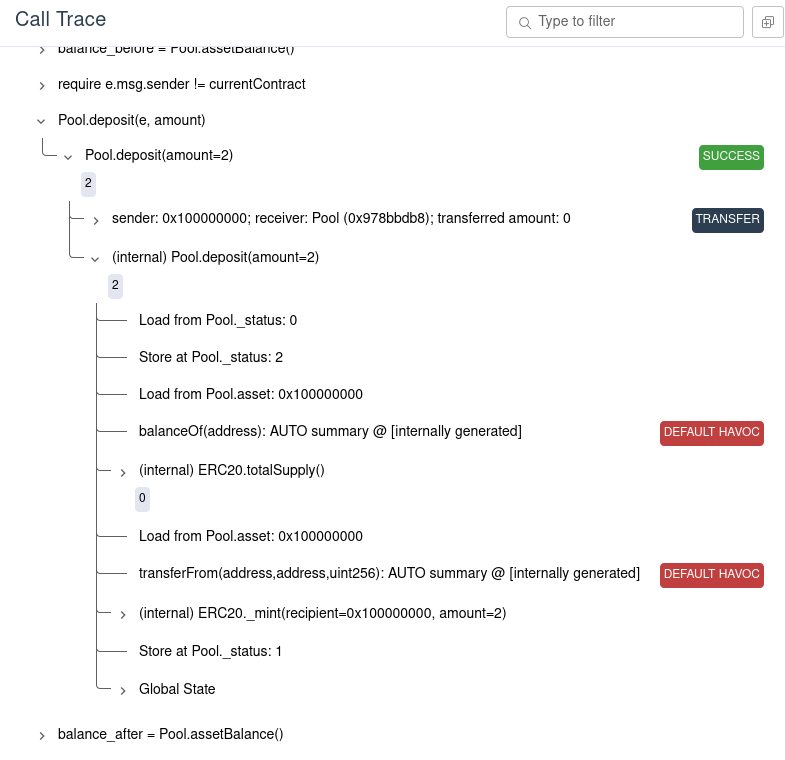

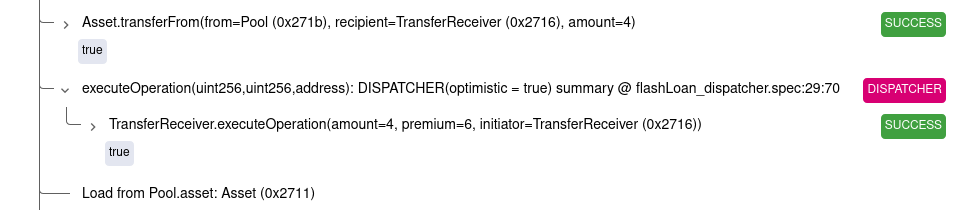

unfold the call trace for the call to deposit:

Here we see that the calls to transferFrom and balanceOf are marked with

“DEFAULT HAVOC”. This means that the Prover lets the call to

transferFrom to change the balances any way it likes. In fact, calls to

asset.balanceOf(...) are also unresolved, so the Prover can choose any return

value that causes a counterexample. In this case, we can see that the Prover

chose 3 for the first return value of balanceOf and 9

for the last return value of balanceOf:

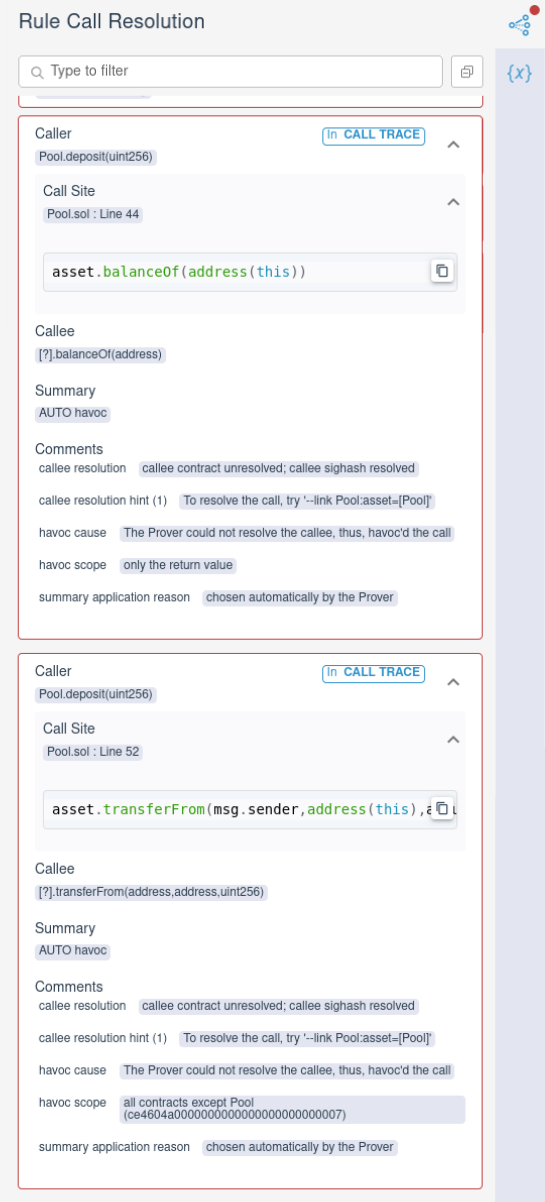

The “Call Resolution” tab on the report provides more information about all of the unlinked external method calls within the contract and how they are resolved by the Prover[2]:

Here we see that the call from Pool.deposit to balanceOf is summarized by

havocing only the return value (since balanceOf is a view method), while the

call from Pool.deposit to transferFrom havocs all contracts except Pool.

Working with known contracts

In the case of the Pool verification, we don’t want the Prover to choose

arbitrary behavior for the Asset, because we have the Asset code. Instead,

we would like the Prover to model the asset contract using the Asset code.

To do so, we must first add the Asset contract to the set of contracts that

the Prover knows about. This set of contracts is called the scene. You

can add a contract to the scene by passing the solidity source as a

command line argument

to certoraRun. The Prover creates a contract instance (with a corresponding

address[3]) in the scene for each source contract provided on the command

line (or the config file).

$ certoraRun contracts/Pool.sol contracts/Asset.sol --verify Pool:certora/specs/pool_havoc.spec ...

Adding Asset.sol to the scene makes the Prover aware of it, but it does not

connect the asset field of the pool to the Asset contract. Although

Pool.asset is declared to have type Asset in the solidity source, the

solidity compiler erases that information from the bytecode; in the compiled

bytecode the field is just treated as an address, and at run time the field

could point to any contract.

To connect the Asset code to the Pool.asset field, we can use the

link option:

{

"files": [

"contracts/Pool.sol",

"contracts/Asset.sol"

],

"verify": "Pool:certora/specs/pool_link.spec",

"msg": "Pool with linking",

"link": [

"Pool:asset=Asset"

],

"rule_sanity": "basic"

}

The --link Pool:asset=Asset option tells the Prover to assume that the asset

field of the Pool contract instance in the scene is a pointer to the Asset

contract instance in the scene. With this information, the Prover is able to

resolve the calls to the methods on Pool.asset using the code in Asset.sol.

With this option, the Prover is no longer able to construct a counterexample to

the integrityOfDeposit rule, so the rule passes. Note that the external calls

to the Asset contract no longer appear in the “Call Resolution” tab, because

the Prover does not report linked calls here.

Accessing additional contracts from CVL

When a contract instance is added to the scene, it is also possible to call

methods on that contract directly from CVL. To do so, you need to introduce

a variable name for the contract instance using

the using statement. In our running example, we can create

a variable underlying to refer to the Asset contract instance[4].

using Asset as underlying;

using Pool as pool;

We can then call methods on the contract underlying. For example, instead of

adding a special method assetBalance to the Pool contract to call

asset.balanceOf for us, we can call it directly from the spec:

/// `deposit` must increase the pool's underlying asset balance

rule integrityOfDeposit {

env e1;

mathint balance_before = underlying.balanceOf(e1, pool);

env e; uint256 amount;

require e.msg.sender != pool;

deposit(e, amount);

env e2;

mathint balance_after = underlying.balanceOf(e2, pool);

assert balance_after == balance_before + amount,

"deposit must increase the underlying balance of the pool";

}

We can simplify this rule in two ways. First, we can declare the

underlying.balanceOf method envfree to avoid explicitly passing in env

variables. This works the same way as envfree declarations for the main contract, except that you must indicate that the method is for

the underlying contract instance [5]:

function underlying.balanceOf(address) external returns(uint256) envfree;

}

The second simplification is that we can use the special variable

currentContract to refer to the main contract being verified (the one passed

to verify), so we don’t need to add the using statement for Pool.

With these changes, the rule looks as follows:

/// `deposit` must increase the pool's underlying asset balance

rule integrityOfDeposit {

mathint balance_before = underlying.balanceOf(currentContract);

env e; uint256 amount;

require e.msg.sender != currentContract;

deposit(e, amount);

mathint balance_after = underlying.balanceOf(currentContract);

assert balance_after == balance_before + amount,

"deposit must increase the underlying balance of the pool";

}

You can run this rule using the WithLinking.conf config file.

Working with unknown contracts

Linking is appropriate for situations when we know the specific contracts that a field points to. In many cases, however, we don’t know what contract an address refers to. For example:

A contract may call a method on a contract address passed in by the user. In our running example, the user may provide any

FlashLoanReceiverimplementation they want to.A contract may be designed to work with many instances of the same interface. For example, a pool might be designed to work with arbitrary ERC20 implementations.

In this case, the only option is to summarize the unknown code for the Prover. Although there are many available types of summaries, the ones most commonly used for unknown code are DISPATCHER summaries.

The DISPATCHER summary resolves calls by assuming that the receiver address

is one of the contracts in the scene that implements the called method. It

will try every option, and if any of them can cause a violation, it will

report a counterexample.

Warning

The DISPATCHER summary is unsound, meaning that using it can cause you

to hide bugs in your contracts. Therefore, you should make sure you understand

the risks before using them. See The dangers of DISPATCHER below.

To demonstrate the DISPATCHER summary, let us prove a basic property about

flash loans. For example, we might like to show that flash loans can only

increase the underlying balance of the pool. We can write the property as

follows:

/// flash loans must increase the pool's underlying asset balance, assuming the

/// receiver has no pool balance.

rule flashLoanIncreasesBalance {

address receiver; uint256 amount; env e;

require e.msg.sender != currentContract;

mathint balance_before = underlying.balanceOf(currentContract);

flashLoan(e, receiver, amount);

mathint balance_after = underlying.balanceOf(currentContract);

assert balance_after >= balance_before,

"flash loans must not decrease the contract's underlying balance";

}

Verifying this rule without any summarization will fail, for the same reasons

that the first run of integrityOfDeposit above failed: the flashLoan

method calls executeOperation on an unknown contract, and the Prover

constructs a counterexample where executeOperation changes the underlying

balance. This is possible because the default HAVOC_ECF summary allows

executeOperation to do anything to the underlying contract.

To use a DISPATCHER summary for the executeOperation method, we add it to

the methods block[6]:

methods {

function _.executeOperation(uint256,uint256,address) external => DISPATCHER(true);

}

This summary means that when the Prover encounters an external call to

receiver.executeOperation(...), it will try to construct counterexamples

where the receiver contract is any of the contracts in the scene that

implement the executeOperation method. We use the wildcard _ as the

receiver contract so that the summary will apply regardless of the receiver

contract.

So far, there are no contracts in the scene that implement the

executeOperation method, so the Prover will conservatively use a havoc

summary for the call, and the rule will still fail. To make use of the

dispatcher summary, we need to add a contract to the scene that implements the

method.

Let’s start by adding a trivial receiver

(in TrivialReceiver.sol)

that implements executeOperation but does nothing:

contract TrivialReceiver is IFlashLoanReceiver {

function executeOperation(

uint256 amount,

uint256 premium,

address initiator

) external override(IFlashLoanReceiver) returns (bool) {

// do nothing

return true;

}

}

Adding TrivialReceiver.sol to the scene allows the Prover to dispatch to it.

To run, use the FlashLoanTrivial.conf

config file.

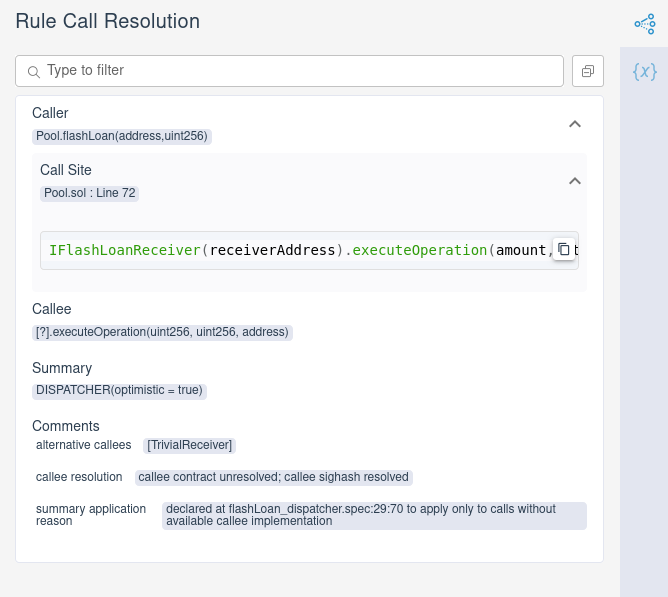

With this dispatcher in place, the rule passes. Examining the call resolution

tab shows that the Prover used the dispatcher summary for executeOperation

and considered only TrivialReceiver.executeOperation as a possible

implementation:

Although the rule passes, it is important to pause and think about what we have proved; the next section shows that we shouldn’t rest easy yet.

The dangers of DISPATCHER

What we have proved so far is that if the only possible FlashLoanReceiver

is TrivialReceiver, then the pool’s underlying balance doesn’t decrease.

However, we have not proved that the underlying balance never decreases after

a flash loan.

Since the DISPATCHER summary only considers the contracts you provide as

possible implementations, it forces you to think about a threat model: the set

of behaviors that you want to protect against. If there is a clever way to

construct a receiver contract that violates the rule, but you don’t think of

it, the Prover won’t be able to find it. So far, we were able to prove the

rule, but only with a very weak threat model: we assume that the flash loan

receiver does nothing.

In fact, we can easily construct a flash loan receiver that decreases the pool’s underlying balance. For example, if the receiver somehow got an approval to transfer underlying tokens away from the pool, it could just transfer them, thereby decreasing the underlying balance of the pool. We can write such a receiver:

contract TransferReceiver is IFlashLoanReceiver {

IERC20 underlying;

uint transfer_amount;

address pool;

function executeOperation(

uint256 amount,

uint256 premium,

address initiator

) external override(IFlashLoanReceiver) returns (bool) {

underlying.transferFrom(pool, address(this), transfer_amount);

return true;

}

}

Note that this isn’t a complete working example; we haven’t provided a

constructor, or linked the pool address to the actual pool, or any way to

ensure that the pool has given the receiver an allowance. Nevertheless, if we

add it to the scene, the Prover is able to use it to construct a

counterexample. Since the Prover explores every possible value of the pool

variable, and every possible value for the underlying’s allowances, it is able

to set up the details of the counterexample automatically.

We do need to do one more piece of setup to get this receiver to work the way

we’d like. If we just add TransferReceiver to the scene, the Prover will not

be able to resolve its call to transferFrom. This will cause the same kind

of havoc we saw above. We could remedy this using a DISPATCHER summary for

transferFrom (see Using DISPATCHER for ERC20 contracts), but for now, we’ll simply

link the underlying variable to the Asset contract instance:

{

"files": [

"contracts/Pool.sol",

"contracts/Asset.sol",

"certora/harness/TrivialReceiver.sol",

"certora/harness/TransferReceiver.sol"

],

"verify": "Pool:certora/specs/flashLoan_dispatcher.spec",

"msg": "flashLoan with transfer dispatchee",

"link": [

"Pool:asset=Asset",

"TransferReceiver:underlying=Asset"

],

"rule_sanity": "basic"

}

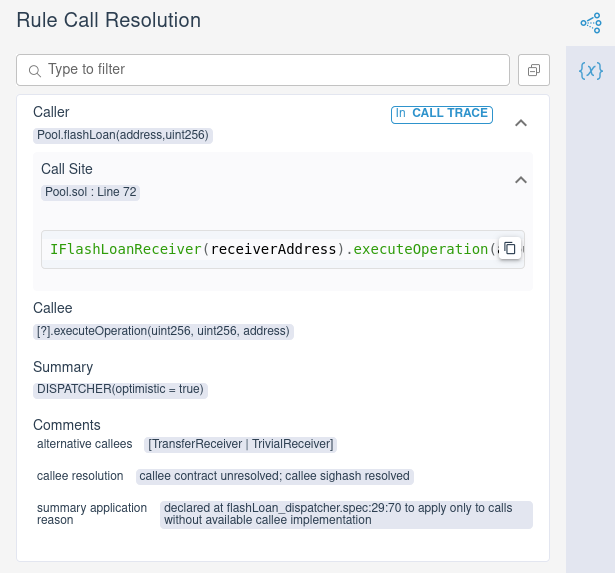

With the additional receiver implementation on the scene, we see that the Prover

considers both alternatives for the executeOperation call:

And we also see that it was able to use the TransferReceiver to construct a

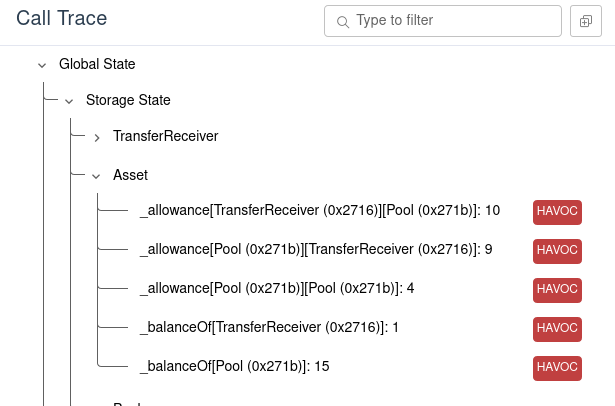

counterexample:

As we expected, the dispatcher for executeOperation chooses

TransferReceiver.executeOperation as the receiver, which in turn calls

underlying.transferFrom(Pool, ..., 2). If we look in the initial storage of the contract,

we see that the Prover chose the pool’s allowance for the recipient to be

10:

It turns out that this particular violation can’t actually happen, because the pool contract never approves any other contract to transfer its funds. We could prove an invariant to this effect and add it to our rule using requireInvariant statements.

For more examples of requireInvariant usage, check out the user guide.

Nevertheless, this example shows that having too few dispatchees can cause a rule to pass, even though the property it describes is not necessarily true in all situations.

Designing flexible dispatchees

The TransferReceiver described in the previous section is fairly targeted: we

thought of a way to violate the rule, and then designed a receiver contract to

cause the violation. However, one of the main benefits of the Prover is that

you don’t have to know in advance the attacks you’re trying to prevent, and

this approach to creating dispatchees loses that benefit.

There is a clever trick you can use to write flexible dispatchees that can cover a broad range of potential attacks. The trick relies on the fact that the Prover will consider all possible values for contract fields when trying to produce a counterexample.

Suppose we wanted to reason about the possibility that a flash loan receiver

could make non-view calls back to the pool from executeOperation. We could

write a separate receiver contract for each method which just calls that method,

and add them all to the scene as potential dispatchees. However, this can

become cumbersome, especially if there are multiple methods that need to be

implemented.

Instead, we can write a single receiver that simulates all of these potential method calls. Let’s start by getting a list of the external methods of the contract. The Prover helpfully provides such a list whenever we verify a rule[7]:

Now, we can write an executeOperation method that could call any of the

non-view functions. We can do this with a big if-then-else statement (

:clink:full contract</DEFI/LiquidityPool/certora/harness/FlexibleReceiver.sol>)[8]:

contract FlexibleReceiver is IFlashLoanReceiver {

IPool token;

function executeOperation(...) ... {

uint callbackChoice = ...;

if (callbackChoice == 0)

token.deposit(...);

else if (callbackChoice == 1)

token.transferFrom(...);

else if (callbackChoice == 2)

token.withdraw(...);

...

else

assert(false, "invalid callbackChoice value");

return ...;

}

}

The value of the callbackChoice variable determines which Pool method

executeOperation will call. We would like the Prover to consider every

possible value of the callbackChoice field, so that it can choose to call any

of the pool’s methods. We would also like the Prover to consider every choice

of arguments to these method calls.

For this to be valid solidity code, we need to actually give values to the

callbackChoice and the arguments to the called methods. To do this, we use a

clever trick. Since the Prover considers every possible value for storage

variables, we can simply use a storage variable for callbackChoice and for

the arguments. For example, we could write

contract FlexibleReceiver is IFlashLoanReceiver {

...

uint arbitraryCallback;

function executeOperation(...) ... {

uint callbackChoice = arbitraryCallback;

...

}

}

The Prover will consider cases where arbitraryCallback can have any possible

value at the beginning of the rule, and we can use this arbitrary value to fill

in callbackChoice[9].

One potential drawback of this choice is that the receiver contract will make

the same callback every time executeOperation is called within a rule. We can

relax this restriction by using a mapping of arbitrary values instead of a

single callback:

contract FlexibleReceiver is IFlashLoanReceiver {

...

uint counter;

mapping(uint => uint) arbitraryCallbacks;

function executeOperation(...) ... {

uint callbackChoice = arbitraryCallbacks[counter++];

...

}

}

With this version, the Prover is able to choose a new value of

arbitraryCallbacks[i] for each i; since the counter variable is updated

on each call, this means that it can choose a different value of

callbackChoice for each call.

The abstract contract ArbitraryValues

makes this simple. For each value type, it provides an arbitraryType() method that

returns an undefined value that the Prover can fill in arbitrarily as it is

constructing counterexamples. For example, the arbitraryInt192() method

returns a newly selected int192 each time it called. In this case, we can

use the arbitraryUint and arbitraryAddress methods to choose the callback

and the arguments (conf file WithFlexibleLinked.conf).

/**

* A flexible implementation of the FlashLoanReceiver callback that

* nondeterministically makes calls back to the token.

*/

contract FlexibleReceiver is IFlashLoanReceiver, ArbitraryValues {

IPool token;

/**

* Nondeterministically call {deposit}, {transferFrom}, {withdraw},

* {transfer}, or {approve} on the {token}.

*

* @return true

*/

function executeOperation(

uint256 amount,

uint256 premium,

address initiator

) external override(IFlashLoanReceiver) returns (bool) {

uint callbackChoice = arbitraryUint();

if (callbackChoice == 0)

token.deposit(arbitraryUint());

else if (callbackChoice == 1)

token.transferFrom(arbitraryAddress(),arbitraryAddress(),arbitraryUint());

else if (callbackChoice == 2)

token.withdraw(arbitraryUint());

else if (callbackChoice == 3)

token.transfer(arbitraryAddress(),arbitraryUint());

else if (callbackChoice == 4)

token.approve(arbitraryAddress(),arbitraryUint());

return true;

}

}

With this implementation, the Prover will consider every possible value for

callbackChoice as well as for the arguments to the methods, which has the

effect of calling an arbitrary non-view method on pool with arbitrary

arguments.

This approach still doesn’t give perfect coverage. If the token field is

linked to the pool, it will only call methods on the pool. In fact, this

receiver will miss the violation that the TransferReceiver uncovered, because

that requires calling transferFrom on the Asset rather than the Pool,

although this particular shortcoming can be

addressed by using a dispatcher for the ERC20 methods

instead of linking to the pool.

Another important caveat is that this technique does not work for initial state

checks for invariants. In this case, the Prover does not choose arbitrary

values for storage variables, since it knows that storage variables are all

initialized to 0 before the constructor call. Therefore, the arbitraryType()

methods will always return 0.

A third shortcoming with this implementation is that it only makes one

reentrant call to the token contract. Vulnerabilities that require two or

more callbacks from the FlashLoanReceiver to exploit will not be detected.

Nevertheless, this technique is a useful way to build dispatchers that get

pretty good coverage without requiring too much prediction of the bugs they

will find. The ArbitraryValues helper contract makes this pattern easy to

implement.

Using DISPATCHER for ERC20 contracts

One very common use case for the material discussed in this chapter is when a

contract is designed to work with arbitrary ERC20 tokens. In this case, it is

common to summarize all of the ERC20 methods using DISPATCHER summaries, and

to provide several ERC20 implementations to the Prover.

To facilitate this, the helpers

directory of the example code contains a

spec file called erc20.spec

as well as a variety of ERC20 token implementations

(inside tokens folder).

The erc20.spec file simply contains a methods block that summarizes all of the

ERC20 methods as DISPATCHER. You can use an

import statement to include this in your spec:

import "../helpers/erc20.spec";

This gives a concise way to handle this situation. Be sure to include the tokens in the scene!

Conclusion

In this chapter, we’ve seen several techniques for handling inter-contract

calls. Linking allows us to give the source code for a contract referenced by

a particular field. DISPATCHER summaries instruct the Prover to consider

several possible implementations of a contract, and can be used when we don’t

know exactly which contract an address will refer to.

We’ve seen that DISPATCHER summaries are not completely safe — they

constrain the possible implementations of external contracts, so they may miss

bugs that those implementations don’t trigger. However, we have seen a useful

technique that can explore a wide range of behaviors with little effort.